Parish Council Accounts is an easy to use cashbook accounting system that aims to provide the accounting functions that a small parish council requires:

- Entering payments and receipts along with analysis

- Bank reconciliation

- VAT126 preparation

- AGAR preparation (Receipts and Payments, or Income and Expenditure)

- Creation of budgets and performance against budgets

- Tracking balances for separate Income/Expenditure streams such CIL and Reserves

Parish Council Accounts can handle the accounts for multiple councils. Each councils accounts are held in a separate data store. Each council can have a number of cashbooks, current accounts, savings accounts, petty cash, etc.

It runs on Windows, so needs to be downloaded to a PC or Laptop running Windows 10 or 11. Once installed and activated, it does not need an internet connection to run.

Parish Council Accounts is available on a subscription basis of £75 per year. There is a free trial period of one month.

Setup

The accounts need to start at the beginning of the financial year (1st April). This is to ensure the AGAR is correct. You can, of course, start using it at any time during a year, but you will need to enter all the previous transactions for that year. You can load transactions from an existing spreadsheet.

To setup the accounts you will need to have the following:

- The opening balance of the all the cashbooks.

- If any cashbook is associated with a bank account, the date and balance of the last statement. Also, a list of the previous year's entries that have not yet appeared on a bank statement.

- List of accounts used to analyse Cashbook Entries.

- Any VAT from the previous year that has not been claimed.

- The opening balance for CIL and any other identified Reserve Accounts

Cashbook Entries

There are 3 types of entries in a cashbook:

-

Normal payments and receipts

These are the day-to-day payments made by the council in carrying out its activities, and the receipts, such as precept, that funds them.

-

Reversals

Once entered an entry cannot be deleted or edited, as it provides and audit trail. However, entries can be reversed (effectively deleting), and re-entered (effectively an edit). Reversals are also necessary for situations where a cheque has been raised but is never presented.

-

Journals

Journals allow you to move amounts between accounts. This can be used to correct an entry where the amount is correct, but the analyses are incorrect, rather than reversing the entry and re-entering it.

A Journal is used to setup any VAT , that was incurred before the start of the accounts, which has not appeared on a refund claim.

Accounts

Every cashbook entry needs a breakdown/analysis in terms of what it represents: Payments represent expenditure, e.g., grass cutting, clerks salary; Receipts come from a particular source, e.g., Precept, VAT refund. The Account structure provides that ability.

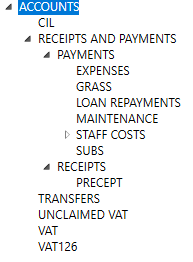

The Accounts are structured hierarchically, as can be seen in the above screen shot, and have an initial structure, which is determined by the requirements of the AGAR and the functionality of the software. These initial Accounts cannot be deleted, but new Accounts can be added as a Sub-Account. The Accounts structure determines how you can analyse your receipts and payments. You can find more details here. Most of the Accounts that you create will be under PAYMENTS, especially if you are reporting on a receipts and payments basis You can create a flat structure, as you would have with a spreadsheet, with all the expense accounts under PAYMENTS or you can structure it more hierarchically.